Under increasingly stringent global emissions regulations, the automotive sensor market is poised for significant growth. Building on our “Guide of Emission System,” here are the key market opportunities driving demand for each sensor category:

1. Regulatory Drivers

- Euro 7 (EU), Tier 3 (US), China 7: All target lower NOₓ, PM, HC, and CO limits, forcing OEMs to adopt advanced after-treatment and monitoring systems.

- Real-Driving Emissions (RDE): On-road testing exposes sensors to harsher environments and wider temperature swings, increasing the need for robust, high-accuracy devices.

- Zero-Emission Zones & Incentives: Cities mandating ultra-low or zero local emissions accelerate hybrid and advanced clean-diesel technologies, each demanding specialized sensors.

2. High-Growth Sensor Segments

| Sensor Type | Market Opportunity |

|---|---|

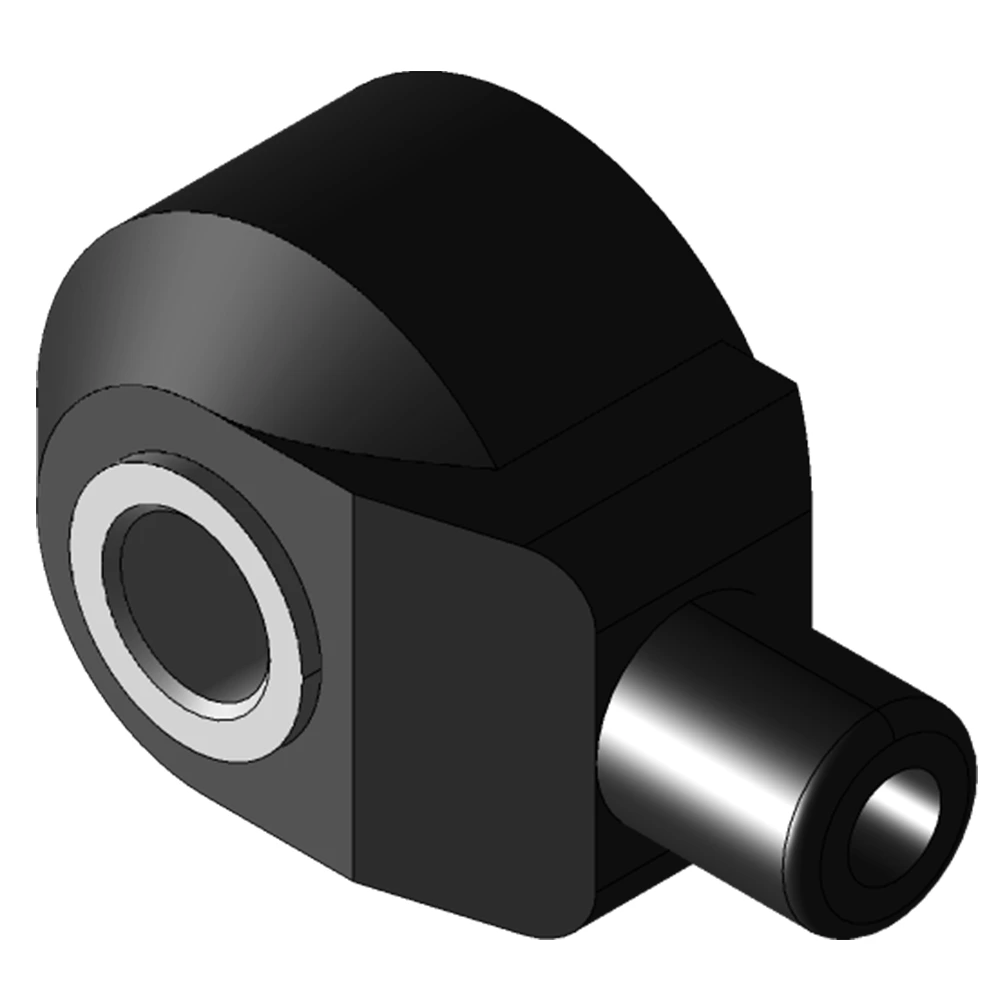

| NOₓ Sensors | SCR systems will proliferate on both diesel and gasoline engines. Demand for dual-NOₓ sensors (pre-/post-SCR) will rise. |

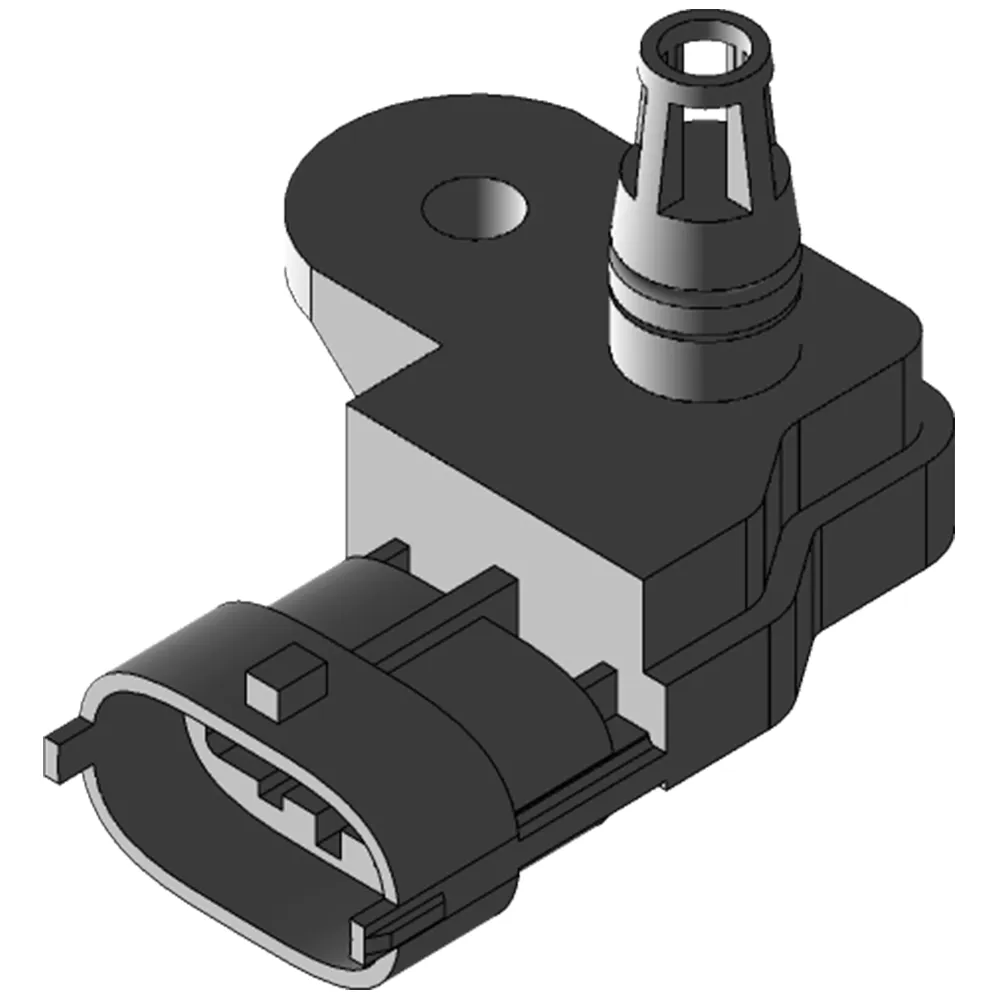

| PM Sensors & ΔP Sensors | Tight PM limits (e.g., PN metrics) drive wider DPF adoption. Up to 20 % CAGR expected in particulate sensing. |

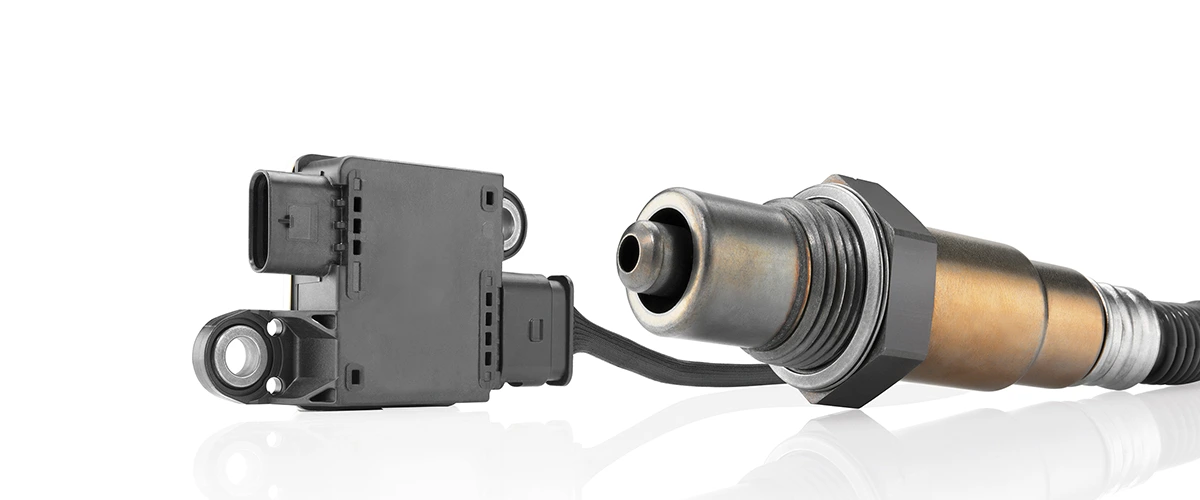

| O₂ (Lambda) Sensors | Ultra-lean-burn and GDI engines need wide-band O₂ sensors for precise air-fuel control—steady growth of 5–8 % annually. |

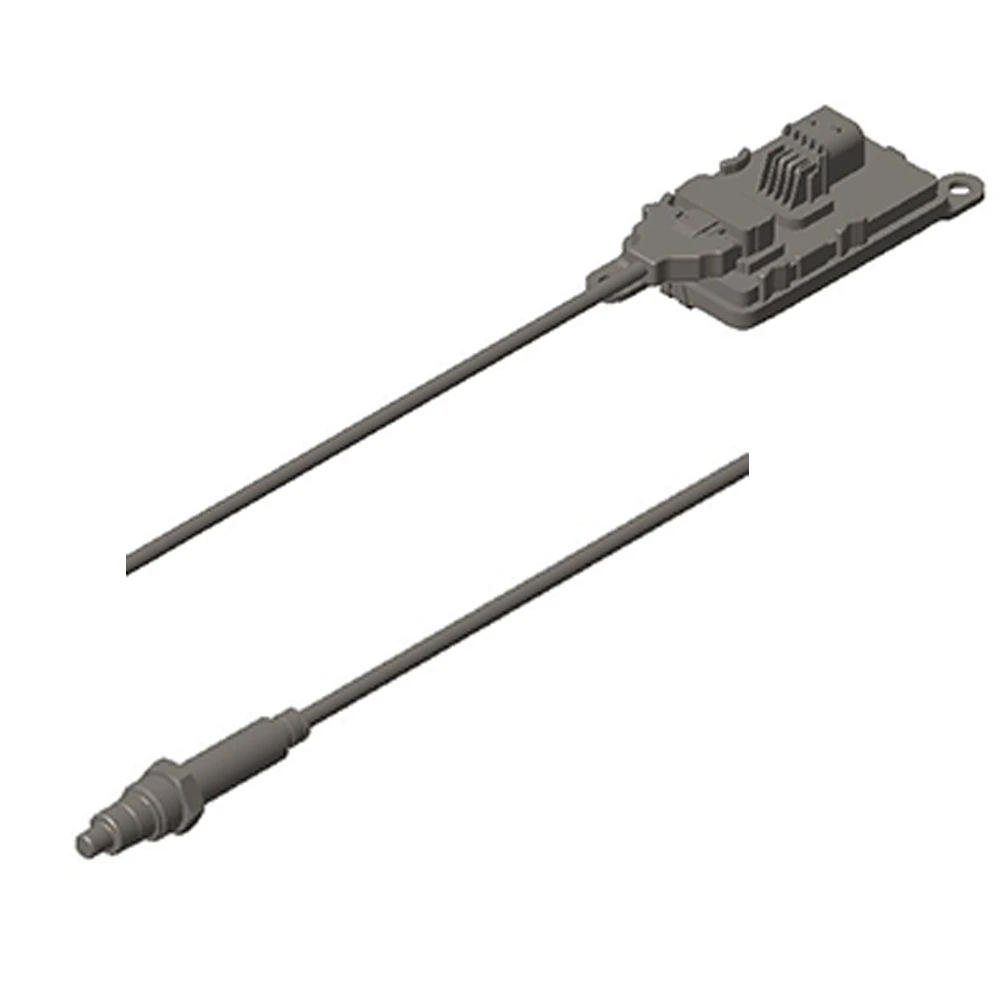

| EGT Sensors | More frequent DPF regenerations and temperature-sensitive SCR catalysts require additional temperature monitoring points. |

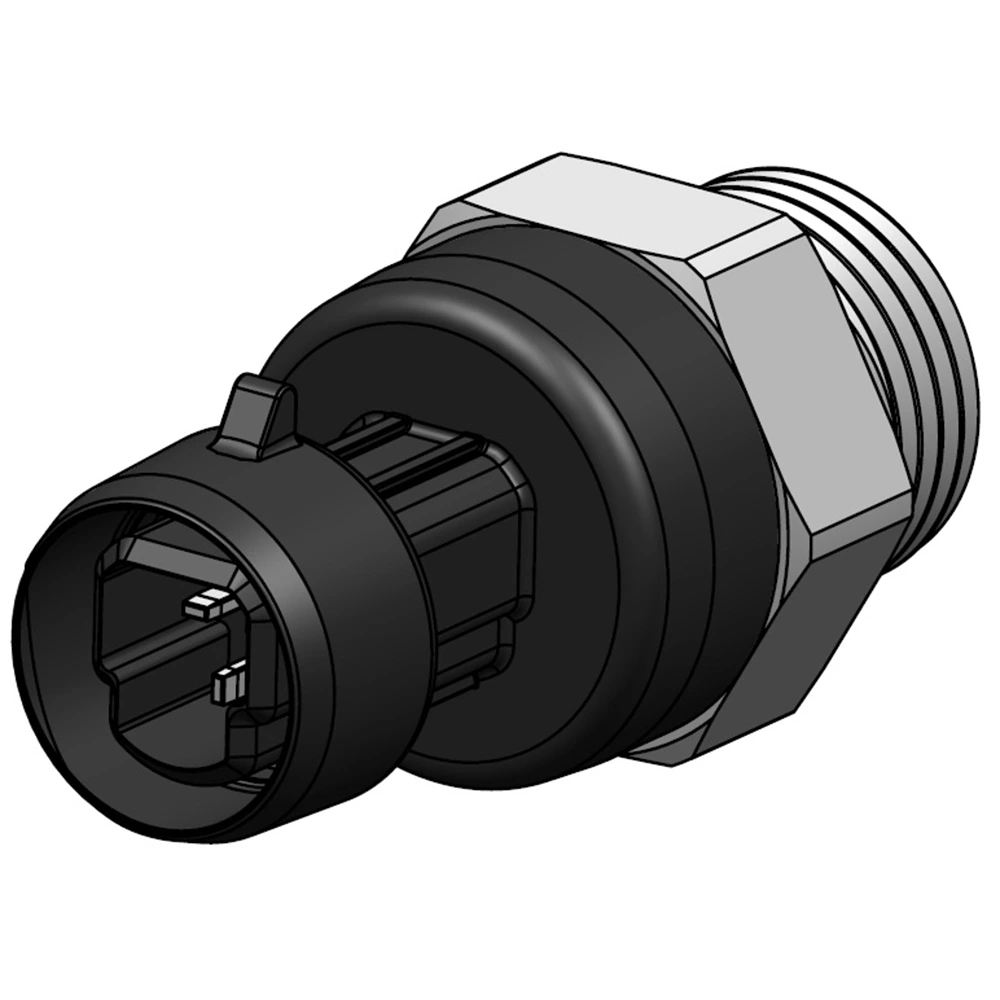

| AdBlue Level/Quality Sensors | As SCR becomes ubiquitous, integrated urea-quality sensing will transition from optional to mandatory. |